[ad_1]

Natee Meepian/iStock by means of Getty Pictures

U.S. home/casualty insurers’ underwriting benefits are predicted to boost this yr on the back of greater top quality prices in underperforming vehicle and house segments, in accordance to scores agency Fitch.

However, promises volatility amid greater inflation and broader macroeconomic uncertainty could hinder a return to underwriting profitability in 2023.

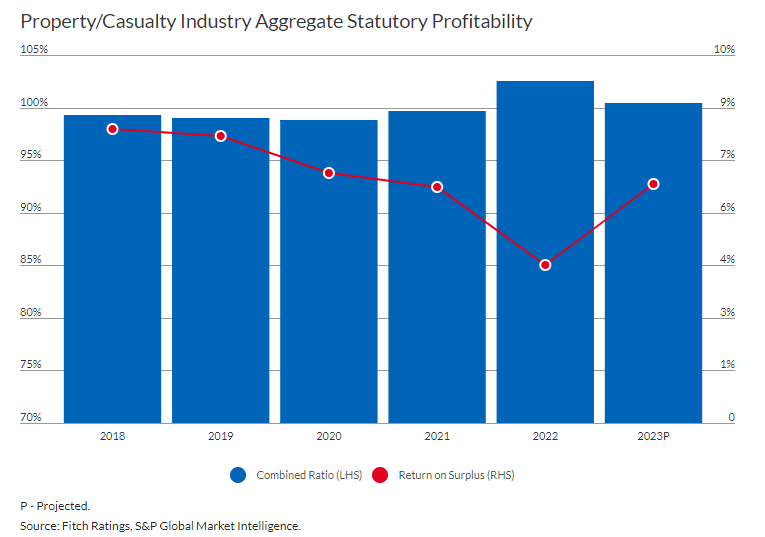

Fitch has a neutral outlook on the home/casualty coverage sector, dependent on stable to strengthening running performance this 12 months. It forecasts a 100.4% field merged ratio for the 12 months.

Own lines will likely make improvements to in 2023, offered recent pricing and underwriting adjustments amid normalizing insured disaster losses. Professional lines total merged ratios are predicted to worsen marginally from present favorable underwriting earnings stages.

Immediate prepared rates expansion will marginally reasonable, but stay bigger than historical norms on robust momentum in private traces rates. Direct published premiums grew in excess of 9% for the 2nd straight calendar year in 2022, aided by industrial and personalized strains charge increases.

Return on surplus fell for the fourth calendar year in a row in 2022 to 4.3%, but is envisioned to rebound this yr. “Variability in all-natural catastrophe losses stay about, compounded by sharp improves in reinsurance fees and a lot less trustworthy obtainable capacity,” Fitch cautioned.

Notice that the SPDR S&P Insurance policy ETF (KIE) received 4.8% in the previous 6 months, but underperformed the 6% obtain in the Find Sector SPDR Monetary ETF (XLF) and the 15.1% maximize in the S&P 500 index.

Before this yr, S&P World-wide Scores revised its look at on the U.S. house/casualty insurance coverage sector to damaging, as a consequence of declining investment values and weaker underwriting success. It expects weaker credit score developments to keep on this 12 months.

[ad_2]

Source url