[ad_1]

Bitcoin’s big stock sector debut is coming at a bad time.

A few of the world’s top makers of cryptocurrency engineering are planning to sell shares, giving traders a new way to bet on digital currencies. They are reportedly hoping to elevate billions of bucks.

Compared with the greenback or the euro, which are issued by central banking companies, cryptocurrencies are primarily based on laptop or computer code. Bitcoin, for illustration, is produced and traded by the “mining” procedure in which personal computer algorithms clear up significantly sophisticated math issues.

Bitmain, Canaan and Ebang, which are all dependent in China, make income by advertising the higher-tech pieces and units that power this mining. Alongside one another, they dominate the company.

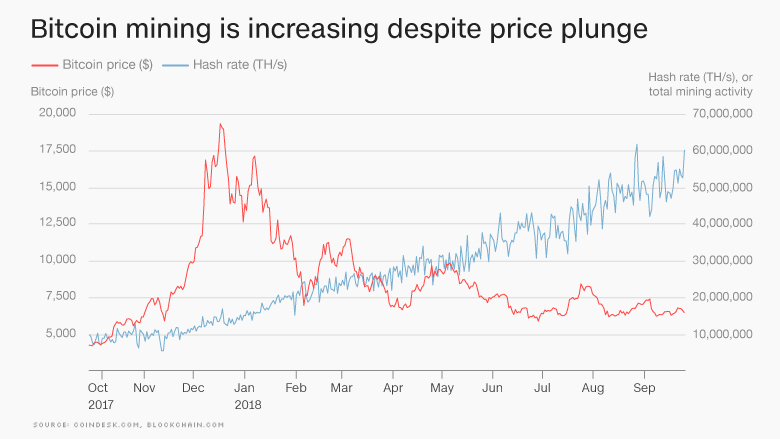

But the a few businesses work in a young, unpredictable industry and are scheduling their IPOs in Hong Kong in brutal market conditions. The cost of bitcoin, which soared to virtually $20,000 in December, has due to the fact plunged by about two-thirds. Other cryptocurrencies like ethereum have plummeted, also.

“If the current market rate of cryptocurrencies abruptly falls … desire for our mining components and cryptocurrency mining services will also drop swiftly,” Bitmain warned probable investors this 7 days.

On major of that, Hong Kong’s inventory market place, where the firms prepare to listing, entered a bear market place this month, owning plunged more than 20% from its preceding peak mainly because of problems about China’s economic slowdown and trade war with the United States.

The mining engineering companies have not stated when exactly they program to go general public or how much they’re searching for to elevate. Bitmain and Canaan declined job interview requests, when Ebang failed to react to a ask for.

“These corporations may possibly be wanting to money out prior to the market place requires an even steeper nosedive,” stated Benjamin Quinlan, founder of Hong Kong-centered economic services consulting company Quinlan & Associates.

He points out that cryptocurrencies are little by little getting extra acceptance among mainstream buyers in spite of latest setbacks, and that the three mining companies’ revenues are nevertheless increasing. But the market faces significant challenges.

A key a person is how governments go about regulating digital currencies. Last year, China banned most routines involving bitcoin. The place is still thought to be home to a major number of cryptocurrency mining operations, but authorities have been attempting to drive them out.

Cryptocurrency miners need to have massive quantities of electricity to operate their rooms entire of computing products close to the clock. Some general public utilities in the United States are previously introducing better tariffs precisely for miners.

“Rising the price of bitcoin mining will lower the demand for mining tools, hindering the effectiveness of these providers,” Quinlan explained.

Mining cryptocurrencies is presently considerably less worthwhile than it made use of to be.

Bitcoin mining exercise has exploded more than the past yr, boosting desire for the know-how. But that suggests the earnings from mining are spread a lot more thinly throughout a increased quantity of users. That could strike long run demand for mining devices.

Will the mining growth very last?

Bitmain, Canaan and Ebang ended up all rewarding in their most recent monetary 12 months, in accordance to paperwork location out their intention to go community.

But remaining in the black will be a “massive challenge,” stated Leilei Wang, a Shanghai-dependent specialist at analysis organization Kapronasia.

The companies are conscious of the risks they deal with and are attempting to adapt. For illustration, they say they are increasing financial commitment in a lot more advanced chip know-how that can be employed in parts like synthetic intelligence, cybersecurity and linked units.

Though the Chinese authorities has a difficult stance on cryptocurrencies in standard, it can be eager to bulk up the country’s technological prowess in parts like laptop chips. Chinese businesses are nevertheless largely reliant on overseas chip engineering, particularly from the United States.

“Irrespective of whether [the cryptocurrency companies] are capable to efficiently pivot continues to be to be viewed,” Wang explained.

For now, their destiny is tied to that of the broader market.

“Cryptocurrencies will very likely fall out of favor” with out higher mainstream adoption in the around potential, Quinlan predicted. The mining products makers “will obtain it extremely tricky to endure when the cryptocurrency marketplace, as a complete, withers away,” he claimed.

But bitcoin bulls are even now hopeful that the forex can phase a recovery as financial exchanges and huge organizations get started to choose it extra very seriously.

“As you see additional adoption of just people staying comfortable with it, it feels like it truly is heading to go up,” Mike Novogratz, CEO of cryptocurrency financial investment organization Galaxy Digital, told CNN this week.

CNNMoney (Hong Kong) Very first printed September 27, 2018: 6:56 AM ET

[ad_2]

Resource url