[ad_1]

Oil extended gains following an industry report signaled a major draw in US crude stockpiles as an ongoing dispute halts exports from Turkey.

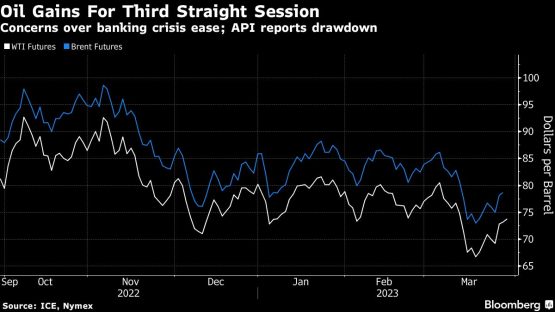

West Texas Intermediate futures rose for a 3rd session towards $74 a barrel, with easing problems about the banking crisis introducing to bullish sentiment. The American Petroleum Institute described crude inventories dropped by 6.1 million barrels previous 7 days, in accordance to persons acquainted with the info. That will be the biggest decline this calendar year if verified by govt figures afterwards Wednesday.

The US is urging Iraq and Turkey to resume exports from the port of Ceyhan soon after a dispute involving Kurdish authorities halted all-around 400,000 barrels a working day of shipments, tightening the industry and aiding to improve prices. Nonetheless, Iraq’s government explained it’s up to Kurdistan to crack the deadlock.

Oil is even now on keep track of for a fifth every month loss just after issues in excess of a possible US economic downturn and resilient Russian flows weighed on prices. OPEC+ is showing no signals of adjusting generation when its Joint Ministerial Checking Committee fulfills up coming 7 days, staying the program amid turbulence in financial markets.

“Supply issues continue on to assistance oil rates,” mentioned Warren Patterson, the Singapore-centered head of commodities system at ING Groep NV. “Market attention will ever more transform to OPEC+ with next week’s JMMC assembly.”

| Selling prices: |

|---|

|

US crude inventories have received ten out of 11 months so much this calendar year, increasing to the highest stage because May perhaps 2021. Analysts surveyed by Bloomberg forecast the Vitality Info Administration will report stockpiles expanded once more previous 7 days, rising by a further more 1.75 million barrels.

© 2023 Bloomberg

[ad_2]

Supply url